The Dark Side of Trading Groups and Newsletter Scams: Real Talk on Losing Your Shirt Online

Let’s get real. You’ve seen the TikToks, the flashy YouTube videos, the Instagram stories: young traders flexing Lambos, “5-minute stock secrets,” crypto moonshots, and newsletter subscriptions promising life-changing gains. You’re hungry for that next big trade. You want the scoop, the insider tip, the golden ticket that’ll turn $500 into $50,000 before your next morning coffee.

And then there’s the other side—the one nobody posts on social media. The side where you get hustled by slick marketing, fake testimonials, and “exclusive” trading groups that are anything but.

At contenthub.guru, we’re here to give you the unfiltered truth about trading group and newsletter scams: the tactics, the setups, the people behind them, and how to avoid being their next victim.

The Setup: How Scammers Lure You In

Trading group and newsletter scams thrive on one thing: urgency and exclusivity. Here’s how the playbook usually goes:

-

The “Insider Knowledge” Hook – You’re told these traders have a system that beats the market, every time. They might throw out screenshots of “real profits” or claim connections to hedge funds or crypto whales.

-

The VIP Group Illusion – Access is limited. Only 50 people can join, only a few spots left. You’re made to feel like an exclusive insider. Humans are hardwired for FOMO (fear of missing out), and these scammers exploit it.

-

High-Pressure Subscriptions – Often, the next step is paying hundreds, sometimes thousands, for “weekly alerts” or “market secrets.” Once you pay, the access is granted—but it’s usually a low-value group with recycled information, outdated alerts, or worse, empty channels.

-

Fake Social Proof – Testimonials, tagged screenshots, and fake Discord members create a sense of legitimacy. These are often bots or paid actors. You’re supposed to believe you’re in the presence of market geniuses.

-

Grooming for Bigger Bets – After the initial subscription, members are encouraged to deposit more into associated platforms, “private deals,” or leveraged trades, which can lead to massive losses.

Sound familiar? That’s because it’s the same template used by crypto scams, pump-and-dump groups, and even some “high-end” options newsletters.

The Psychology Behind the Scam

Scammers are basically professional psychologists with a knack for finance. They manipulate three main triggers:

-

Greed – The promise of fast money, easy wins, and bragging rights.

-

Fear – “Everyone’s making money while you sit there watching your portfolio stagnate.”

-

Trust – They position themselves as mentors, gurus, or insiders. Once they have your trust, it’s easier to get your wallet.

Even savvy traders get caught. The difference is, those who survive these scams learn to spot patterns, not promises.

Real Cases You Need to Know

Here are a few recent, trending examples that made headlines:

-

Crypto Pump Groups – In 2025 alone, Reddit and Telegram-based crypto pump groups netted millions in coordinated price manipulation. New traders would buy a coin at $0.10 based on “exclusive alerts,” only for insiders to dump at $0.15, leaving retail traders holding the bag.

-

Options Newsletter Fails – A newsletter promising 100% returns on options trades turned out to be a compilation of past trades cherry-picked to make it look profitable. Subscribers who tried to follow the system live lost nearly their entire bankroll within months.

-

Discord Day Trading Scams – Some Discord servers charge hundreds per month for day trading “VIP channels.” The advice is generic, delayed, or directly contradicts the market timing. Many users report consistent losses, despite being promised “guaranteed alerts.”

How to Spot a Trading Newsletter Scam

Guaranteed Returns – Any promise of guaranteed profits is a huge red flag. The market doesn’t work that way.

Pressure Tactics – Scarcity, time limits, and urgency are classic sales manipulations.

Unverifiable Claims – If they can’t prove their trades through verifiable accounts, it’s probably fake.

Push for Larger Investments – Once you deposit a little, you’re often coaxed into bigger bets.

No Transparency – Look for a clear business entity, proper regulatory info, and real credentials. If it’s all “DM us for info,” run.

Aggressive Recruitment – Some groups reward members for bringing in friends—essentially turning you into a recruiter for the scam.

Protect Yourself

-

Do Your Homework – Check reviews, forums, and news sources. Ask tough questions.

-

Start Small – Never invest more than you’re willing to lose.

-

Verify Identities – Use LinkedIn, SEC filings, or brokerage confirmations when possible.

-

Question Social Proof – Photos, testimonials, and screenshots can be faked. Don’t trust them blindly.

-

Avoid Leverage – The risk multiplies. Scammers love to use it against you.

Trending Warning Signs Right Now

As of 2025, here are the latest red flags catching attention on trading forums and social platforms:

-

AI-Generated Trade Tips – Some newsletters now use AI to generate “customized” trade alerts. The results are often garbage but look convincingly personalized.

-

NFT and Crypto Combo Alerts – Promises of stock gains bundled with NFT giveaways. Usually a pump-and-dump tactic.

-

Influencer Collabs – Big-name – Big-name social media influencers promoting groups without disclaimers. Their posts are sponsored, and the product may be sketchy.

What We Know

At contenthub.guru, we’ve analyzed hundreds of complaints and firsthand accounts. Here’s the takeaway:

-

Most trading scams aren’t illegal by default—they skirt the line by selling information, not actual trades.

-

The scammers rely on human psychology more than financial strategy.

-

Even legitimate trading communities can become toxic if pressure to perform or deposit grows.

FAQ: Trading Group and Newsletter Scams

Q1: Can I ever trust trading newsletters?

A: Only if they provide verifiable trade history, transparent methods, and regulatory compliance. Even then, skepticism is key.

Q2: Are free trading groups safe?

A: Free doesn’t always mean safe. Free groups often upsell services or push risky trades. Observe for patterns before engaging.

Q3: How can I report a scam?

A: Report scams to your local financial regulatory agency (SEC in the U.S.), and consider alerting forums to warn other traders.

Q4: Can Q4: Can social media influencers be trusted for trading advice?

A: Approach with caution. Paid promotions may hide conflicts of interest, and influencer advice is rarely personalized.

Q5: What’s the fastest way to recognize a scam?

A: If it promises guaranteed profits, high urgency, or secret insider access, it’s almost certainly a scam.

Final Thoughts

Trading can be lucrative, but the allure of insider groups and newsletters often leads to losses, disappointment, and frustration. At contenthub.guru, we believe in informed trading over blind hype. The next time someone slides into your DMs promising “exclusive alerts,” remember: if it sounds too good to be true, it probably is.

Your portfolio is your responsibility. Keep learning, stay skeptical, and don’t let flashy graphics and high-pressure sales tactics dictate your decisions.

Suggested for You

Kai Cenat’s Streamer University: Chaos, Culture, & the New Classroom of Internet Stardom

Reading Time: 6 min

A deep dive into Kai Cenat’s Streamer University: what it promised, what really went down, cultural ...

Read More →

The New Wave of Content Creators: From Music to Fitness and Everything In Between

Reading Time: 6 min

Explore the diverse world of content creators making waves in 2025, from musicians like DDG to fitne...

Read More →

Xbox in 2025: The Console That Won't Quit

Reading Time: 6 min

Explore the latest in Xbox news, trending players, and gaming setups in 2025. From Game Pass to Seri...

Read More →

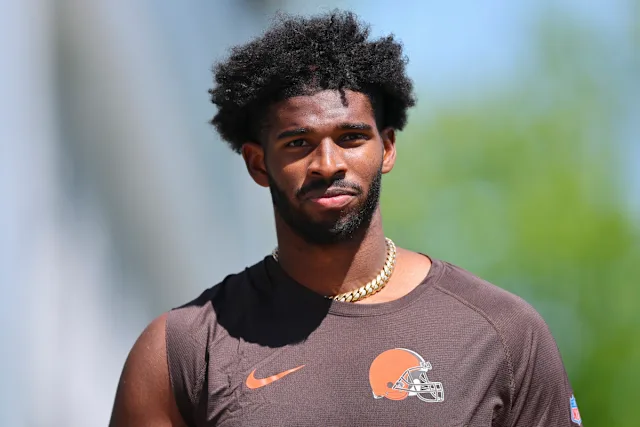

Shedeur Sanders: From Draft Day Drama to Browns' Rookie Quarterback

Reading Time: 6 min

Shedeur Sanders' journey from a late-round draft pick to a viral sensation with the Cleveland Browns...

Read More →

Comments